I discuss the loss of bitcoin's market dominance, the proliferation of alternative, special-purpose cryptocurrencies, and the way in which this fragments the cryptocurrency markets. I argue that due to the structure of financial incentives for both developers and investors, this fragmentation is likely to continue. I argue that a solution to the bitcoin scaling problem may also imply a solution to the fragmentation problem, by facilitating abstraction layers for cross-chain swaps. I discuss the Lightning Network, a recently-launched technology that addresses these problems.

2017 was an interesting year for cryptocurrencies, primarily marked by outstanding growth. The price of bitcoin rose from $980 to $13,170,[0] peaking slightly north of $20,000 on some exchanges. Some new bitcoin also came into existence, so it's helpful to look at the market capitalization, which rose from $15.5b to $220.9b, representing an increase by 1,326%.

Beyond bitcoin, there are many other cryptocurrencies (“coins”).[1] The year began with 617 coins listed on CoinMarketCap, and finished with 1,335. The total market cap of all coins rose from $17.9b to $601.4b — a 3,260% increase.

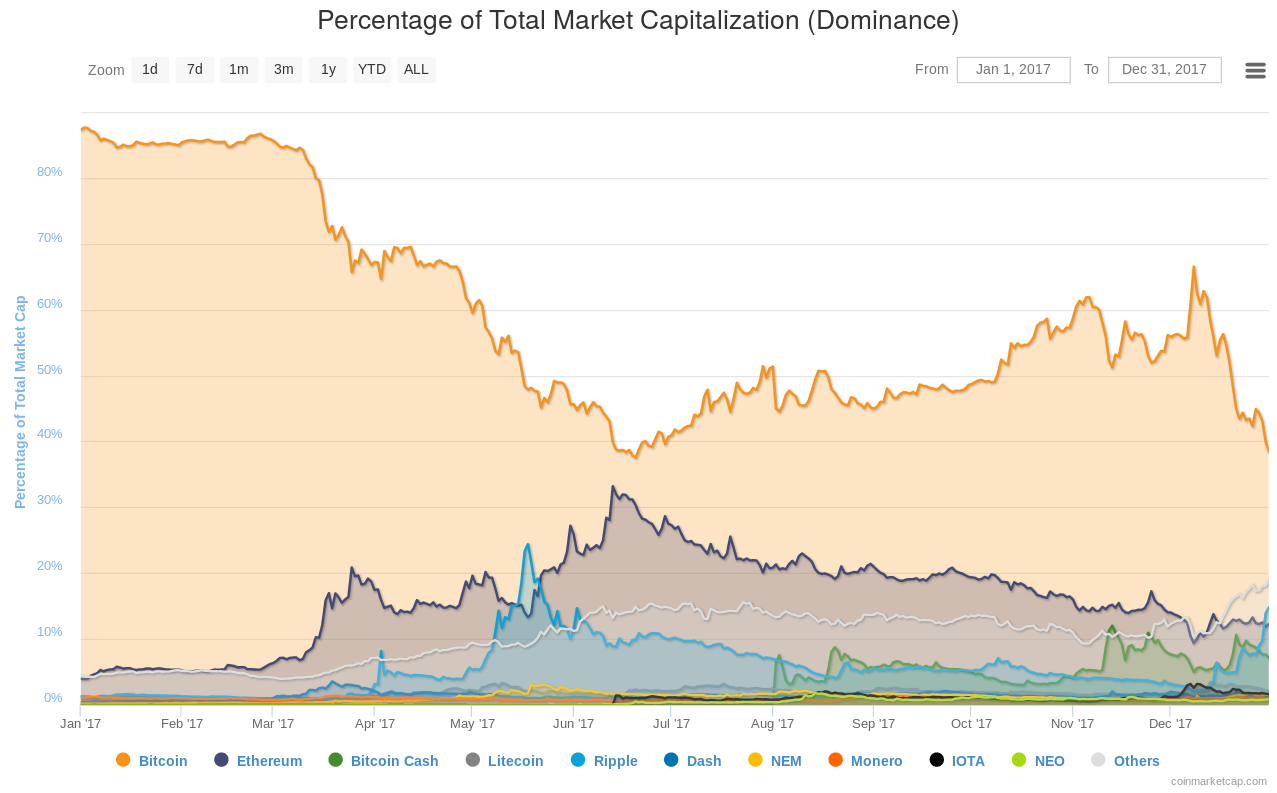

Though some might call 2017 the year of bitcoin, these statistics should give us pause. Bitcoin started with its market cap accounting for 87% of the total cryptocurrency market cap, and finished at 38%. This was the year that bitcoin lost its dominance.

The matter is not just the growth of main technological competitors (e.g. Ethereum, Ripple, Bitcoin Cash), but rather the proliferation of smaller, reasonably successful cryptocurrencies. By December 31st, there were 31 coins with market caps greater than a billion dollars, and 149 coins with market caps greater than $100m.[2] And though it's popular in the cryptocurrency community to deride the vast majority of coins as useless, poorly engineered, or fraudulent (oftentimes all three), it's hard to deny that there are now many legitimate projects that show genuine technological promise.

The issue with this is that the promising cryptocurrencies generally serve niche use cases, and no single coin is doing a good job at consolidating all these technologies. For example, let's say you monetize your blog using the Basic Attention Token. You trade into Augur, so that you can place a bet on a prediction market. You want to trade into ZCash, so you can send someone money totally anonymously, but there might not exist a market for trading between ZCash and Augur, so you first have to trade from Augur into bitcoin, the de facto reserve cryptocurrency, from which you can then trade into ZCash. Finally, you might trade into Stellar, so you can send money almost instantaneously at a low cost. In terms of actual use beyond speculation, this is an ecosystem that is quickly becoming as fragmented and frictious as the technologies of yesteryear.

In theory, this isn't a problem, because all the code for these currencies is open-source, meaning that developers can freely adapt the best features of other cryptocurrencies. When alternatives to bitcoin first appeared, the prevailing community opinion was that there would eventually be many coins in competition with one another, rapidly adapting each other's features, and this competitive iteration would yield the best technologies, much like how competition in traditional markets is thought to produce the best products for the consumer.

In practice, however, this is not at all the case. 2017 has shown technological governance (the decision-making process for making changes to cryptocurrency protocols) to be the hardest problem in the space.[3] The best example lies in the scaling debates: as cryptocurrencies gained popularity in 2017, operating those networks at scale became difficult. Due to the size of the network, bitcoin presently takes around half an hour to process any transaction, at a cost of around $15. A proposed solution ended up bitterly splitting the community, with a new coin, Bitcoin Cash, emerging as a consequence.

Thus, it is not at all obvious whether any meaningful consolidation of special-purpose coins will occur in the near future. Any single large technological change to a cryptocurrency is likely to split its community and produce a forked coin in the process. Beyond that, one might argue that the space is suffering because there is a proliferation of coins that are essentially forks of one another; i.e. not meaningfully differentiated. There are, fundamentally, two reasons for this, both of them variations on a misalignment of financial incentives.

Suppose you have an idea for a cryptocurrency feature, e.g. a way to make transactions anonymous. You have two options: either you try to add this feature to an existing coin, or you build your own coin based on this feature. In the first case — suppose you try to add your feature to bitcoin — you not only have to carefully refactor existing code to accommodate your innovation, but persuade the rest of the developers to support your feature, and ensure that it has the blessing of the major mining pools. What, beyond sheer idealism, incentivizes you to do this? It's not like you get to draw a salary for your work.[4] The only financial incentive exists if you already hold significant amounts of bitcoin, and expect your work to cause a non-trivial price rise. This means that you need enormous amounts of skin in the game: beyond investing a great deal of time, you also need to hold on to tens, if not hundreds of thousands of dollars in bitcoin to have any hope of making a reasonable profit.

On the other hand, you could also just create your own cryptocurrency. Because other coins are open-source, you can trivially lift all the boilerplate code from others. All the factors that might slow you down in the former case, like having to reach consensus with other developers, are totally mitigated. And the financial incentives are compelling: as the first miner, you're going to capture a lot of the early coins, or you might even bake in a reward scheme that rewards you, the creator, with some percentage of mined coins.[5] In this scenario, the only thing you risk is your time. Even that is possible to mostly mitigate by running an ICO based on your whitepaper, which would hopefully yield funding for the development phase.

In terms of financial incentives, this is a total no-brainer for any potential cryptocurrency contributor. Attempting to bring a major feature to a major cryptocurrency makes sense only if you have large amounts of time and are already heavily invested in that coin. There are very few people to whom this description applies.

Investing in cryptocurrencies is tricky, because the markets and technologies are still highly immature. While it is very likely that cryptocurrencies in general still have significant upside, it's hard to predict which ones will succeed in the medium or long term. At the end of 2017, fifty-six out of the top 100 cryptocurrencies had not existed at the start of the year.[6]

As such, considering the difficulties that many of the older coins are facing, and the promise that some of the newer projects are showing, it is reasonable for an investor who is bullish on a small-cap coin's technology to expect it to have much more upside than one of the established coins.[7] For bitcoin to double in price at this point requires significant capital inflow from outside the ecosystem, whereas a coin with a $500m market cap could double in price simply based on good news.[8] Especially if you believe that the eventually-dominant cryptocurrency is yet to be invented, and that technological and political developments and corresponding price movements over the long term are hard to predict, then it makes sense to apply a venture capital-style, power-law driven approach: purchasing small amounts of all promising cryptocurrencies, in the hope that some of them will 10x, maybe 100x, etc. and that these winners will greatly overcompensate for the losers.[9]

This style of investing supplies capital across the board, and reduces the dominance of any one given coin. This indirectly contributes to technological fragmentation, because the market capitalization of a coin is seen as social proof of its legitimacy, thus influencing consumer behavior.

The current structure of financial incentives in the space leaves no clear end in sight for technological fragmentation. In the near term, I expect to see significant growth for special-purpose coins, i.e. a significant number of coins joining the $500m-$5b market cap range, solving problems specific to niche applications and industries. Importantly, if these special-purpose cryptoassets solve existing problems in useful ways, then they will succeed regardless of whether or not they contribute to fragmentation in the general cryptocurrency market. If such assets succeed individually (excerbating fragmentation) en masse, then the value of solving the fragmentation problem will only increase.

It's worth noting that a significant cause of fragmentation is that the major cryptocurrencies (i.e. Ethereum and bitcoin) struggle to scale their networks. Transactions are problematically slow and expensive. As such, there are many coins which offer little beyond faster transactions — these include some of the very largest, such as Bitcoin Cash, Litecoin, Dash, Ripple, and Stellar.[10] If the scaling problem were solved, then these coins would become obsolete overnight. We would see consolidation in the market, where the winners would largely be determined by network effects.

What's critically important is that solving the scaling problem may imply solving the fragmentation problem. Suppose you hold cryptocurrency X and need cryptocurrency Y to buy item Z. If both currency X and Y had solved their scaling problems, such that you can make near-instant microtransactions on either blockchain, then this enables a service that lets you buy item Z with currency X, performing a swap between X and Y under the hood. If two blockchains X and Y have solved their scaling problems, then it's possible to build a cross-chain swap layer on top, enabling you to transact with currency Y even if you only hold currency X. Then it doesn't matter how many competing coins there are, you only need to hold one to be able to use all of them.[11]

Solving the scaling problem renders technological fragmentation a non-issue: there can be arbitrarily many cryptocurrencies, but the markets between them will be highly liquid, which is the only thing that really matters.

Thus far, attempted solutions to the scaling problem have culminated in technologies like Ripple and Stellar: semi-centralized cryptocurrencies that promise fast transactions on-chain. They have not been able to win over significant end-user trust, and because their mechanisms are, due to their semi-centralized nature, infrastructurally different from almost all other cryptocurrencies, they have also not led to any progress in facilitating cross-chain swaps.

It seems that the most promising solutions to the scaling problem — which don't compromise decentralization — are higher-level abstraction layers that enable transactions and settlements off the underlying blockchains. In the past, when people tried to transact in commodities that were highly illiquid, they developed credit or representational layers on the underlying: instead of sending barrels of salt around your kingdom, you can just transact in certificates that represent barrels of salt, and settle the certificates and receive the actual barrels only when that's necessary. This historical analogy implies some centralization, but it may be possible to achieve a decentralized/trustless modern equivalent.

One such protocol is the Lightning Network, a transactional layer on top of bitcoin, which went live in January 2018, and is currently being tested in production. If the Lightning Network succeeds, then we're going to see bitcoin's transaction capacity rise from seven transactions a second to millions of transactions per second,[12] with totally negligible fees. Beyond that, the Lightning Network promises cross-chain atomic swaps,[13] which would enable you to transact with any Lightning-enabled cryptocurrency even if you hold a different one. Notably, because it's built on bitcoin, the Lightning Network is interoperable with any cryptocurrency that is a bitcoin-fork and has activated Segregated Witness.[14] Currently, that's only a few coins,[15] but there will be more in the future.

There are some other recent innovations that are worth mentioning in this vein. The 0x Protocol enables trading of ERC20 tokens on the Ethereum blockchain, with off-chain order relays that offer low transactional costs, but on-chain transaction settlement. The developers at 0x are planning to eventually branch out to performing general cross-chain swaps as opposed to just for ERC20 tokens, but that's well in the future. The Kyber Network is aiming to launch arbitrary token trading on their platform in Q2 2018. They're presently running a testnet. OmiseGO is similarly offering cross-chain transactions as part of their wallet.

We're still many months out from gauging the success of Lightning and others, but if Lightning or a similarly interoperable abstraction layer were to succeed, it would be the greatest possible contributor to the long-term success of cryptocurrencies. I can think of no other factor that would even come close in terms of impact.

[0] All figures are from CoinMarketCap, as of January 1 and December 31, 2017. I saved a copy of that data, available here.

[1] Incidentally, not all proclaimed cryptocurrencies are secured by cryptographic protocols in the way that bitcoin is. The nomenclature in this space is not perfect.

[2] If we want to be statistically rigorous, we might say that the distribution of market caps across coins was an extremely platykurtic exponential distribution, and the kurtosis has increased slightly; i.e. tails have become slightly fatter.

[3] Perhaps only second to coordinating with actual political governance.

[4] There's a caveat in that some contributors are paid by donations or by organizations such as Blockstream, which provides funding for certain improvements to Bitcoin Core.

[5] This example is actually the story of ZCash, which is a cryptocurrency enabling totally anonymous transactions based on zk-SNARKs, a particular application of zero-knowledge proofs. ZCash is otherwise a fork of bitcoin, i.e. it is essentially bitcoin code with a zk-SNARK transactional layer. The ZCash developers could just as well have petitioned to add a zk-SNARK layer to bitcoin, Litecoin, or any of the other major coins. But they instead implemented ZCash as its own coin, ostensibly because that's much faster than trying to add such a layer to any other coin, and because the ZCash founders reserved a 10% reward of all ZCash for themselves, which is a rather compelling financial incentive.

[6] Where "top" is measured by market capitalization, as usual.

[7] This may also be because it is easier to value a niche product. For example, if there is a cryptocurrency or blockchain-based solution to a particular technological problem that costs $x per year, then its addressable market and potential upside can be calculated quite easily, since there are few variables in play. On the other hand, it is difficult to estimate — even to an order of magnitude — how much a general-purpose transactional cryptocurrency could be worth in an optimistic scenario.

[8] This happens all the time. Quite often, these good news are fake news, but such is marketing.

[9] Another way to characterize this approach is that in the long-term, having exposure to the entire sector (i.e. to the mean coin) is probably far more valuable than having exposure to the median coin.

[10] On December 31, these coins had a total market cap of about $143.6 billion, i.e. 25% of the total cryptocurrency market cap.

[11] Ironically, this would likely bolster bitcoin's position in the market, since it already functions as the de facto reserve cryptocurrency.

[12] This is the seemingly-optimistic estimate by Lightning engineers. Even if this is an overshot and the network can only support in the thousands of transactions per second, that is still a massive improvement, and puts bitcoin in the range of major credit card processors by volume. For reference, VISA processes about 1,600 transactions per second, with an estimated peak of 56,000 transactions per second.

[13] I found this older explanation of atomic swaps (specifically as applied to the Lightning Network) reasonably useful. Here's some further, more recent discussion.

[14] More precisely: in order to be Lightning-compatible, it is not required for a cryptocurrency to be a strict bitcoin fork. What's required is for a blockchain to use the same hash function as bitcoin for creating time locks, and the ability to create time locks in transaction scripts. Bitcoin forks trivially fulfill these requirements.

[15] As of January 28, 2018: bitcoin, Litecoin, Decred, and VertCoin are Lightning-compatible.

Thanks to Alexander Liegl and Evan Zimmerman for helpful feedback on earlier drafts of this piece.

This article is intended for informational purposes only. The views expressed in this article are not, and should not be construed as, investment advice. This article is not an offer, nor a solicitation, to transact in any of the assets discussed. There is no guarantee as to the accuracy or completeness of the views expressed in this article. These views are subject to change.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.