I propose that people possess implicit currencies, such as data, social capital, time, and attention. Abstractly, most online monetization strategies are conversions of aggregated micropayments in these implicit currencies into dollars. Because these conversion processes are generally lossy, I propose that people's implicit currencies are critically undervalued. This poses two threats: firstly, from a consumer-protection standpoint, users never know what they're giving up, and are structurally positioned to be exploited. Secondly, it is unclear how feasible such monetization strategies will be as these markets become more efficient and users expend their implicit currencies, potentially leaving them unable to access products that are currently considered both "free" and "essential".

The advertising industry has largely enabled the Internet as we know it: the vast majority of sites you might use are free, with no barriers to access. In the early days of the Internet, monetization was simple: on your site, you might display some ads related to the content, and hope that some users click on them. The advertiser might pay you a flat rate for hosting the ad, or per ad click. We've come a long way since then. Ads are now displayed and priced dynamically. Data that advertisers have on you is used to decide which ads to show, often subject to a bidding process governed by high-frequency exchanges.[0] The market is cornered by Google and Facebook, who receive 73% of all online advertising revenue in the US, and capture about 99% of the growth in this market.[1] The game is now fundamentally about data: advertisers seek to build ever more accurate profiles of users, so that in the future, they may be shown ads they're more likely to click on.

Thus, the objective of many sites is now to capture user data: the data that you generate or expose by browsing the Internet. Examples includes your browsing history, gender, GPS coordinates at a point in time, Facebook pictures, the identities of your friends, tweets, ads you've clicked on, etc. As such, I propose that users possess data as an implicit currency. Let's define an implicit currency by the following characteristics:

- It's an abstract thing that people have, not a financial instrument in the traditional sense, i.e. unlike US dollars, Swiss Francs, bitcoin, gold futures, etc.

- It has extremely low transactional costs and is available in extremely small units, thereby lending itself well to micropayments.[2]

- It can be aggregated by any party, and converted into a traditional currency, like US dollars.

It is easy to see how user data is an implicit currency: everyone has it and generates more all the time. The transactional costs are minimal — it's a trivial data transfer, and any datapoint, no matter how small, is valuable because it assists in crafting a better profile of the user. Additionally, the economic value of the data increases in the amount of the data: the larger the dataset, the better models it yields. Most importantly, this data can be quite directly turned into dollars. Examples include:

- Crafting better user profiles to better target ads, thereby increasing advertiser revenues.

- User behavior data can be used to optimize flows within websites and create user experiences most likely to induce purchases or perpetuate high user engagement.

- User-provided data (e.g. labelled images, sounds, GPS data, etc.) can be used to train machine learning models, which can then be turned into profitable, standalone products, e.g. voice transcription services, image identification, machine translation, etc. It's worth expanding on this: the central thesis at Google and many other leading tech companies is that AI will change everything in the next few decades. They're rushing to build weak AI in every conceivable domain, and users are providing them with the data to get the job done. Though the present viability of this monetization avenue is debatable, the future potential is enormous.

What's critically important is that these conversion processes are generally lossy (inefficient). For example, the advertisement industry — which pays for user data en masse — has a significant amount of inefficiency that is priced into the product. Plenty of consumers are unreachable due to ad blockers. Bots accounted for 7.2 billion dollars in ads fraud last year.[3] In June 2017, Procter & Gamble cut $140 million from its advertising budget, and saw no impact on sales.[4] The implication is simple and important: if this process turns data in dollars in an inefficient fashion, then the data put into the process must be worth more than the dollar output. Thus, the consumer is likely to be vastly overpaying with their data for any "free" product.

This raises a few issues. First off, it's hard to pin-point the monetary value of types of user data, and even if you could, they're probably in perpetual flux. So, even if you wanted to trade some of your data for access to a website, it's hard to know what a "fair" trade would be.[5]

Secondly, you never know how wealthy or poor you are in terms of user data. It's clear that some kinds of data, like your credit card records, are much more valuable than others, like your tumblr history. And a company only needs to obtain your data once in order to store it — if some advertiser already knows that you like cheeseburgers, it's not valuable if you supply that data again. So the question is: what does that advertiser already know about you? Have you already given up the really valuable data? And of course you have no idea, because these transactions are implicit. You go to a website, and a tracking cookie adds that visit to your user profile. You might sign up with your email, and the site might sell your email address to a data broker. You don't get a receipt for any of this. It's like trying to manage a bank account and never being allowed to look at the balance.

Granted, not knowing your "data balance" is currently not a concern to anyone. But it's likely to be a concern in the future. Currently, the advertising markets are very inefficient and still making money hand over fist, so there's a lot of space for waste. But these markets will gradually become more efficient, the margins thinner, and companies will have to economize more carefully.

This could have unpleasant — but entirely plausible — effects that consumers are currently not expecting. Websites that are currently "free" for you to use are generally making money off you by showing you ads, which you might click on every once in a while, or by selling your data. Suppose there's such a site that sells your user data to some advertiser. What would happen if the advertiser were to conclude that you'll never click on any ads? What if the advertiser already knows everything they want to know about you? What if you have no further useful data to offer to the advertiser, and they'll only want a bit of data from you in a few weeks, to update their models? In all of these cases, it is entirely rational for the advertiser not to pay that site for your data. In turn, it is entirely rational for that site to cease letting you waste their bandwidth — and thus you're locked out.

My great fear is that as the data/advertising markets inevitably become more efficient, consumers will find out, to their horror, that all these "free" online products were never free, that they've unwittingly been paying with their data all along, that they have actually been ripped off for years, and after they've been milked for all they're worth, they're data-poor and those "free" products are then completely inaccessible (unless they're willing to pay in some other way).

In what other ways might users pay for online products? Actual currencies, like USD or Zcash are certainly options. The Basic Attention Token, courtesy of the Brave project, offers a way to monetize online content with micropayments. However, it's hard to get people to pay for stuff with real money when they're used to not doing so. There are other potential implicit currencies. Among them, social capital currently looks most compelling. You may have seen paywalls for online content/products that deal in social capital:

- "You can view this video after you share this link on Facebook..."

- "To access this content, please re-tweet this tweet..."

- "To access this content, at least three people need to click this referral link:..."

These are presently rare, but the advertising potential is clear: word-of-mouth is powerful. People will always trust their friends and social media circles more than ads displayed in sidebars.[6] It follows that advertisers could powerfully leverage your social capital. The tricky thing with social capital — just as with data — is that you expend it, and rarely do you know how wealthy or poor you are in terms of social capital.

Just as with user data, there's a dystopian scenario to bring the point home: imagine that instead of paying for Netflix with dollars, you have "free" access because you post every TV episode you watch as a status update on Facebook. But eventually, you've posted so often that none of your friends click the links anymore, so it's no longer effective advertising for Netflix. In turn, it doesn't make sense for Netflix to pay for your bandwidth, and you're locked out. This would suck, in itself, but especially so given that you've expended your social capital: your friends have muted you on Facebook. This consequence would not have been obvious to anticipate, and it would have been a terrible trade to save a few dollars a month.

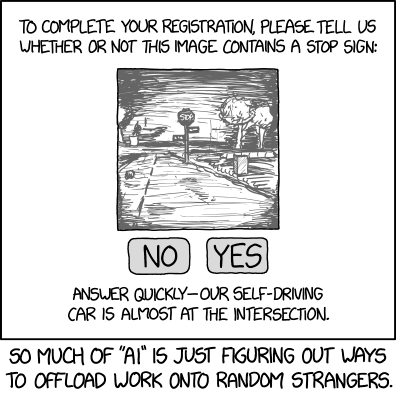

Cases can be made for other forms of implicit currency in which you might pay for access. For example, you've probably solved CAPTCHAs. Most of these involve you typing out a messily written word, or clicking on all the images containing some object. What's happening here is that you're training a machine learning model that recognizes words or labels images, respectively. This is almost like traditional work: you're making a micropayment in a combination of your time, labor, and knowledge. Possibly, all of these are implicit currencies.[7]

Thus, I believe that as the advertising industry matures, the biggest questions in tech are going to center around how to monetize products by means other than ads:

- What are people's implicit currencies?

- How do we convert these implicit currencies into dollars?

In particular, I expect that the biggest theme of the advertising industry over the next few years is going to be about capitalizing on people's social capital. Everyone has it, and it's enormously valuable for advertisers. To some extent, Instagram — which, as a platform, is all about displaying social capital — might be the first real entrant in this market: so-called "Instagram influencers" make a great deal of money by partnering with advertisers.[8] I expect there to be a very lucrative future for the companies leading the market in capturing social capital and other new forms of implicit currency.

This leaves one important question, which is how to protect the consumer in this regard. Implicit currencies make it extremely hard for their possessors to ever know how much they have, how relatively wealthy or poor they are, and the nature of these implicit transactions leaves the consumer with no idea how much they're paying, if they're even aware that they're making transactions at all. Moreover, notions like "personal data" or "social capital" and the expenditure thereof are abstractions that are likely difficult for many consumers to reason about, leaving them wide-open to being hyperbolically short-changed.

In the long run, this is a consumer-protection nightmare, and also seriously calls into question how feasible this economic model is for creating social good. If users unsustainably over-expend in the various implicit currencies, then they may not be able to pay for services and products that everyone presently considers both "free" and "essential", like social networking or Internet search.

However, there's something of a silver lining on the horizon: implicit currencies seem to restore over time. Even if you expend all your social capital, you'll gain more over time just in the regular course of living your life, and even if you expend all your user data at one point, you'll generate more shortly. Regardless, this does not solve the practical problem of implicit currencies being hard for their users to value, and the ethical problem of the user being taken advantage of in this respect. I strongly hope that advances in micropayments — whether in fiat or crypto — will give users more fair[9] and transparent choices for accessing online content without abstractly bankrupting themselves.

Thanks to Jill and Jason for their helpful feedback on earlier drafts of this piece.

[0] Source: Bloomberg News

[2] Generally defined as a transaction of value less than $5.

[3] Source: Association of National Advertisers

[4] Sources/Related Reading: Marketing Dive and Business Insider

[5] Chicago economists might derisively sneer at the notion of a "fair" price and argue that the only meaningful concept here is a market-clearing price, i.e. economic equilibrium. I disagree — my intuition is that the market-clearing price in this domain likely imposes significant negative externalities on the public, but that is out of scope for this article.

[6] In fact, people will trust their friends and social media circles more than just about any other news source, which led to the proliferation of "fake news" that spread on social media in recent years.

[7] There certainly is a case to be made for time, since it is the scarcest economic resource — one of my favorite adages is that money is nothing but a measurement of one's ability to harness other people's time.

[9] In this context, the word "fair" probably means efficiently priced.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.